Many people assume that anyone with a financial title is required to give advice based on what’s best for the client. But that’s not always the case. Some advisors can recommend products that benefit their firm more than their clients. Others are limited to a short list of investments, even if better options exist.

If you’re thinking about working with an advisor, or already have one, here are a few ways to know whether the advice you’re receiving is truly built around you.

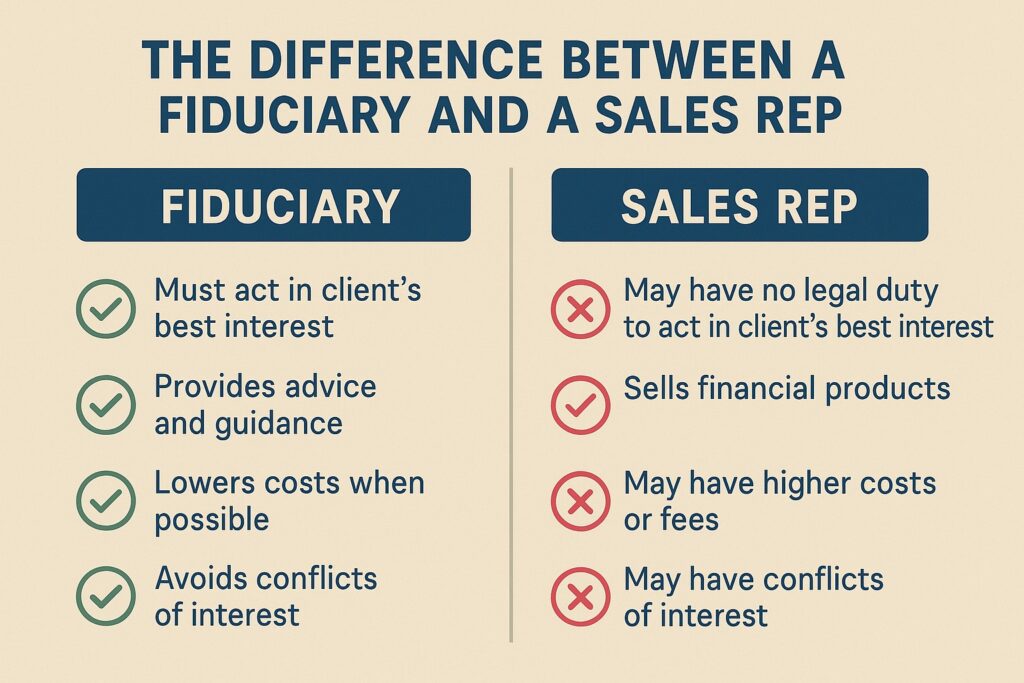

The Difference Between a Fiduciary and a Sales Rep

One of the most important distinctions in financial services is whether the person giving you advice is held to a fiduciary standard.

A fiduciary is legally obligated to act in your best interest. They must disclose any potential conflicts and provide guidance that supports your specific financial situation.

That’s different from someone who works under a suitability standard. Under that model, the recommendation just has to be considered “suitable,” not necessarily the best choice. In many cases, these advisors are paid commissions when they sell certain products, which can create pressure to recommend one option over another.

If transparency matters to you, working with a fiduciary financial advisor can give you peace of mind that the advice you receive is based on your priorities, not a sales quota.

Questions That Help Reveal What’s Driving the Advice

Asking the right questions can help you understand how an advisor operates. Here are a few to consider:

- How are you compensated?

This helps uncover whether their income is based on commissions, fees, or a mix. Fee-only fiduciaries typically have fewer conflicts. - Do you receive incentives for recommending certain products or services?

Some firms reward advisors for using in-house funds or insurance products. - Are you required to act as a fiduciary at all times?

Some advisors are fiduciaries in certain situations but not others. Full-time fiduciaries are held to a higher standard consistently. - What kinds of clients do you typically work with?

This can help you determine whether they have experience with people who have similar goals or financial situations.

If your advisor avoids these questions or gives vague answers, that may be a sign to dig deeper.

Independent Advice Makes a Measurable Difference

Financial lives are rarely one-size-fits-all. The more complex your assets, tax situation, or long-term plans, the more critical it becomes to work with someone who can look at the full picture and make unbiased recommendations across multiple areas.

This is where independent investment planning makes a real difference. Independent advisors are not tied to a single bank, brokerage, or product lineup. They can help you choose from a broader range of investment options, planning tools, and legal structures. That flexibility gives you more room to align your financial strategy with your personal life, whether you’re preparing for retirement, managing a business exit, or planning to support family over time.

An independent advisor can also coordinate with tax professionals and estate attorneys. That coordination helps you make smarter decisions across the board, not just within your portfolio.

Fee Transparency Builds Trust

People who work with an advisor often want to know precisely what they’re paying and what they’re getting in return. Unfortunately, many traditional models make it hard to get a straight answer.

That’s why fee-only advisors have become more common among clients who value clarity. These professionals are paid directly by the client for their advice, not through product sales or commissions. That structure removes a significant source of bias.

Working with a fiduciary who also operates under a fee-only model can help eliminate second-guessing. You know how your advisor gets paid, and you can trust that their recommendations are based on your long-term outcomes.

Why Fiduciary Standards Matter More Than Ever

It’s one thing to get advice. It’s another thing to know that advice is being given for the right reasons.

Fiduciary advisors must consider your whole financial situation and recommend what truly benefits you. They take the time to understand your risk comfort level, your timeline, and your personal goals. They’ll tell you when something doesn’t make sense and help you avoid decisions that could create unnecessary risk or cost over time.

This is important during periods of change or uncertainty. Market shifts, job transitions, health events, and family changes can all impact your financial picture. A fiduciary’s role is to help you adjust your strategy without losing sight of your bigger objectives.

That level of accountability isn’t always easy to find. But when it’s in place, it gives you confidence that your financial decisions are grounded in a relationship you can trust.

Your Financial Life Deserves More Than a Sales Pitch

Choosing the right advisor isn’t about products or pressure. It’s about clarity, trust, and knowing the guidance you receive is built around your complete financial picture. Our full-time fiduciaries at Virtue Asset Management act in your best interest, every time, without exception. If you want objective advice backed by experience, we’re ready to have that conversation.