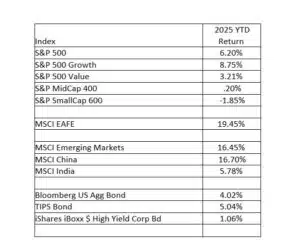

The S&P 500 ended the second quarter at all-time highs, rising 10.94% during the quarter and posting a 6.20% gain year-to-date. After a 19% correction that bottomed in April, the index has now entered a new bull market and is 55 trading days removed from its recent low. The market’s resilience is notable given several headwinds: the administration’s tariff war, a negative first-quarter GDP print (driven largely by companies front-loading inventories ahead of tariffs), the ongoing war in Ukraine, and a twelve-day conflict between Israel and Iran including a U.S. strike on three Iranian nuclear sites. Despite these challenges, earnings have remained strong—helped in part by delays in tariff implementation—and investor enthusiasm around artificial intelligence (AI) continues to build.

At Virtue Asset Management, we believe we are still in the early stages of the AI cycle. We are actively seeking individual stock opportunities that align with this long-term theme. Given the market’s positive momentum and solid earnings backdrop, we continue to recommend a neutral weighting to equities. For clients with new cash that won’t be needed over the next 12 months, we suggest putting that money to work in the market.

The bond market saw considerable volatility in the first half of the year. Inflation concerns and expectations of higher interest rates drove the 10-year Treasury yield to a peak of 4.78% in January. However, rising recession fears reversed that trend, bringing yields down to 4.01% by April, before stabilizing at 4.29% by the end of June. The resulting decline in rates contributed to a 4.02% return year-to-date for the Bloomberg U.S. Aggregate Bond Index—surpassing the full-year performance in three of the past four calendar years.

Despite early efforts by Doge and initial conversations about fiscal responsibility, the political realities in Washington have largely derailed any meaningful attempts to control government spending. The abandonment of potential austerity measures has removed a key headwind that could have slowed economic growth and equity markets.

While concerns remain about the long-term debt outlook for the United States, it’s important to note that high debt levels are a common feature among the world’s largest economies. Japan, for example, has a debt-to-GDP ratio nearly twice that of the U.S., yet its 10-year government bond yield is just 1.43%—the lowest among major developed nations. The broader fear is that excessive debt could eventually overwhelm a country’s financial system, creating a negative feedback loop in which rising interest rates trigger runaway inflation.

At Virtue Asset Management, we believe the United States remains the strongest and most resilient economy among its global peers— “the best house on the block.” In our view, a coordinated global response will eventually be necessary to address the mounting debt burdens across major economies.

On a more immediate note, the extension of tariff relief and optimism around the administration’s efforts to finalize trade agreements have helped ease inflation expectations. Some Federal Reserve officials have even suggested that rate cuts could begin as early as July. Markets are currently pricing in three 25-basis-point cuts by year-end, which would bring the federal funds target range down to 3.5%–3.75%. There is approximately a 20% probability of a rate cut in July. If the economy and corporate earnings continue to show strength in the second half of the year, we believe these rate cuts could act as a positive catalyst for equity markets.

The Artificial Intelligence (AI) theme remains a powerful force driving equity markets. NVIDIA has emerged as the largest company in the S&P 500, with a market capitalization surpassing $3.7 trillion. The current market leadership is concentrated in companies providing the essential infrastructure for AI—ranging from semiconductors to power—for the data centers enabling this technology. Meanwhile, some of the previous decade’s tech leaders, including Apple and Alphabet, have seen their stock prices decline over the past year as investors reassess their long-term positioning in an AI-dominated landscape.

At Virtue Asset Management, we believe the AI cycle is still in its early stages. We continue to seek fairly valued companies that are well positioned to benefit from this long-term structural trend. We also believe the United States remains the most dynamic environment in the world for entrepreneurship and innovation. This positions U.S. markets to benefit from the emergence of new AI-focused businesses. As a result, we maintain a strategic overweight to U.S. equities relative to international markets.

Earnings expectations for the S&P 500 in 2025 are projected at $256 per share. Looking ahead to 2026, analysts are forecasting 16% earnings growth, bringing estimates to $296 per share. Over the past decade, the S&P 500 has traded at an average price-to-earnings (P/E) ratio of 21.46. Applying this historical multiple to the 2026 earnings forecast implies a price target of approximately 6,350 for the index—about 4% above current levels.

As a forward-looking mechanism, stock prices are a function of both interest rates and corporate earnings. The stock market requires either stronger-than-expected earnings, lower interest rates or a willingness by investors to pay a higher P/E multiple in order to push valuations meaningfully higher. At Virtue Asset Management, we believe a balanced approach is prudent. We recommend clients maintain a neutral allocation to equities while ensuring sufficient cash is available to cover expected expenses over the next 12 months.

Investing involves risk, including the possible loss of principal and fluctuation of value. Past performance is no guarantee of future results.

This letter is not intended to be relied upon as forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date noted and may change as subsequent conditions vary. The information and opinions contained in this letter are derived from proprietary and nonproprietary sources deemed by Virtue Asset Management to be reliable. The letter may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projection and forecasts. There is no guarantee that any forecast made will materialize. All information is illustrated gross of investment advisory fees. Reliance upon the information in this letter is at the sole discretion of the reader. Please consult with a Virtue Asset Management financial advisor to ensure that any contemplated transaction in any securities or investment strategy mentioned in this letter align with your overall investment goals, objectives and tolerance for risk. Additional information about Virtue Asset Management is available in its current disclosure documents, Form ADV and Form ADV Part 2A Brochure, which are accessible online via the SEC’s investment Adviser Public Disclosure (IAPD) database at www.adviserinfo.sec.gov, using CRD#283438.

Virtue Asset Management is neither an attorney nor an accountant, and no portion of this content should be interpreted as legal, accounting or tax advice.

Source: Best Financial Advisors in Oak Park | Certified Wealth & Fiduciary Planner | Virtue Asset Management